Spotify Upgrades Lyrics With Offline Access, More Translations

February 4, 2026China And Hong Kong Stocks Slip As Tech Drag Returns

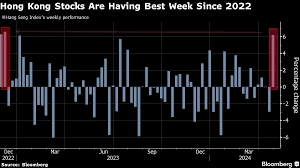

China and Hong Kong stock markets weakened as technology shares slid again, dragging broader indexes lower and dampening investor sentiment across the region. After recent rallies, renewed selling pressure on China tech stocks and hongkong tech stocks signaled a return of volatility, countering earlier optimism in equity markets.

Market participants noted that losses were led by tech and innovation-oriented companies in both mainland China and Hong Kong, highlighting how sensitive growth-oriented equities remain to shifts in risk appetite. The downturn comes at a time when some sectors had shown resilience, but persistent pressure on tech shares weighed heavily on overall performance.

Tech Shares Take the Brunt of the Decline

The recent slide in share prices was most pronounced in the technology sector, where major names saw significant pullbacks after periods of strong gains. Mainland Chinese tech companies, as well as Hong Kong-listed technology firms, experienced broad selling, reflecting caution among investors who had previously chased growth stocks.

This retracement in china tech shares contributed to declines in key indexes, with tech drag emerging as the dominant force in market movement. Even indexes that had benefited from inflows into growth and tech sectors earlier encountered renewed pressure as traders adjusted positions in response to changing sentiment.

Mainland China Market Moves

Across mainland markets, broad indexes saw mixed performance as investors weighed economic data and corporate earnings prospects. While indicators in the services sector pointed to pockets of strength, slower momentum in manufacturing and other cyclical areas tempered enthusiasm. Together with tech sector weakness, this environment pushed overall market performance into negative territory for recent sessions.

Analysts noted that while some investors remain optimistic about China’s longer-term growth prospects, near-term headwinds — including global liquidity shifts and investor risk aversion — have contributed to the slide in equities.

Hong Kong Stocks and Investor Behavior

In Hong Kong, technology stocks were among the weakest performers, and the broader hong kong chinese stocks complex also felt the impact. The retreat in tech names translated into broader declines, underscoring how interconnected markets have become between mainland China and Hong Kong.

Recent sessions also showed that investor appetite can shift quickly. Only weeks earlier, hong kong stocks are looking hot again as chinese money pours in, with inflows helping lift valuations in several sectors. But when tech valuations come under pressure, sentiment can reverse swiftly as traders rotate out of high-growth names and seek safety in other areas or more defensive plays.

Broader Market Themes and Sector Divergence

Despite the tech downturn, some non-technology sectors showed relative resilience, with banks, consumer staples, and renewable energy stocks holding up better in the face of broader weakness. This divergence highlights that while tech performance often leads market moves, broader equity trends are influenced by a mix of sector dynamics.

The retracement in tech also echoes previous corrections, where major tech benchmarks retraced from highs after periods of aggressive growth. Those earlier episodes demonstrated that tech valuations can be especially sensitive to shifts in investor risk tolerance, regulatory concerns, and macroeconomic signals.

What This Means for Investors

For investors focused on china tech stocks and china tech shares, the recent pullback underscores the ongoing volatility in growth-oriented sectors. Technology companies remain central to many portfolios, but rapid swings in valuation reinforce the importance of risk management and long-term perspective.

Some long-term investors may view these dips as potential entry points, especially for companies with strong fundamentals and leadership positions in key industries. However, the near-term outlook remains uncertain as markets continue to digest evolving economic data, sector rotation trends, and global sentiment shifts.

Looking Ahead

While the current slowdown in tech performance has created headwinds for broader markets, investors will be watching closely for signs of stability. Potential catalysts could include stronger economic indicators outside tech, renewed appetite for growth stocks, or improved earnings momentum.

Until clearer signals emerge, volatility in tech shares is likely to continue shaping market direction for both mainland China and Hong Kong equities. The interplay between tech sector trends and broader market confidence will remain a key focus for analysts and traders alike as they navigate this dynamic environment.

FAQ

❓ Why are China tech stocks falling?

Technology shares have faced renewed selling pressure as investors adjust risk sentiment, leading to broader market declines.

❓ Are Hong Kong tech stocks also declining?

Yes, Hong Kong technology stocks have also slipped, contributing to broader weakness in the market.

❓ Can this tech slump become a buying opportunity?

Long-term investors may view dips as entry points, but near-term volatility could persist until clearer market signals emerge.

Elevate Your Brand with MasterInDesign

Don’t let your business get left behind in today’s fast-paced digital world. At MasterInDesign, we specialize in helping brands stand out, engage audiences, and grow online.

Take the next step toward digital excellence. Contact us today and transform your brand into a powerful online