Marvel Avengers: Doomsday Trailer – Release Date, Leaks, Reddit Buzz & Official Update

December 18, 2025

Steven Spielberg Movie Disclosure Day: Release Date, Trailer, Cast & Plot

December 19, 2025Japanese Interest Rates Shift After Decades of Low Costs

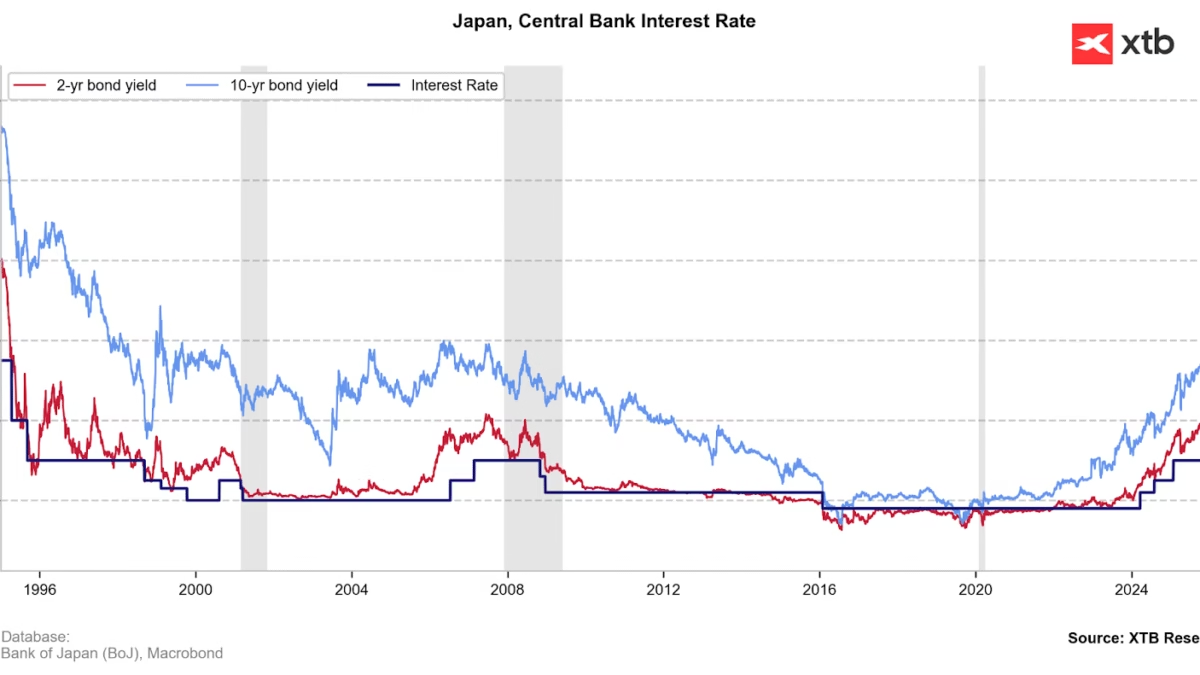

Japan’s interest rates have become a central focus for global markets as the Bank of Japan pushes ahead with monetary policy changes that mark a historic departure from decades of ultra-low rates. The decision to raise benchmark interest rates reflects evolving economic conditions at home and abroad.

This year’s developments have brought fresh attention to japanese interest rates 2024, historical japanese interest rates, and questions about what lies ahead for borrowers, savers and markets.

From Negative to Positive: A Big Policy Change

For years, Japan operated under a policy of extremely low or even japanese negative interest rates. These levels were intended to combat persistent deflation and stimulate lending in an economy that struggled with slow growth and demographic challenges.

Economists often asked why are japanese interest rates so low, given the global backdrop of rising borrowing costs elsewhere. The answer has long centered on Japan’s prolonged struggle with inflation and its unique economic structure.

In 2024, the Bank of Japan made its first major shift away from negative territory, marking a turning point after years of accommodative policy. This change reset expectations for future borrowing costs across the economy.

Recent Interest Rate Decisions and Market Impact

In late 2025, policymakers followed up with another increase in the key policy rate, raising it further after earlier adjustments. This latest japanese interest rates hike signaled the central bank’s intent to normalize policy gradually, while still keeping borrowing costs relatively modest compared with other advanced economies.

The decision was driven by a mix of domestic price pressures and changing global financial conditions. As a result, current japanese interest rates now sit in positive territory, representing the most significant shift in decades.

Observers noted that this was not a dramatic jump but a clear indication that the era of exceptionally low borrowing costs is ending. The move has broader implications for financial markets, corporate borrowing, government bonds, mortgages and consumer confidence.

Why Japanese Interest Rates Have Been Low for So Long

Decades of low growth and inflation challenges shaped policy decisions that kept rates at or near zero. Following a prolonged period of economic stagnation in the 1990s and 2000s, policymakers relied on unconventional tools, including very low short-term rates and stimulus measures designed to spur investment.

These conditions made Japan an outlier among major economies, where higher inflation generally leads to higher rates. The legacy of low rates influenced japanese loan interest rates, japanese savings account interest rates, and japanese bond interest rates for years.

This long period of low borrowing costs helped support certain parts of the economy, but it also left policymakers with limited tools when new inflationary forces began to take hold.

Japanese Interest Rates Forecast and Future Outlook

Looking ahead, analysts share mixed views on where japanese interest rates forecast may go next. Many believe that further gradual increases remain possible if inflation remains above the central bank’s target and economic performance is stable.

Others warn that too aggressive a pace could dampen growth or harm household finances. These contrasting views reflect ongoing debate about how best to balance price stability with sustainable economic activity.

Impact on Mortgages and Consumer Borrowing

One of the most tangible effects of rising interest rates affects japanese home loan interest rates. Homeowners and prospective buyers are paying closer attention to how changes in the policy rate translate into higher mortgage costs.

Higher borrowing costs can extend to consumer loans and other forms of credit, influencing spending decisions for households and businesses alike.

Effects on Savings and Investments

As rates rise, returns on japanese savings account interest rates become slightly more attractive than in past years. This marks a shift for savers who have endured negligible or even negative real returns.

At the same time, yields on government bonds, particularly japanese long term interest rates, are responding to expectations of further policy tightening. These movements reflect broader expectations about inflation, economic growth and future rate adjustments.

Short-Term vs Long-Term Rates

Both japanese short term interest rates and longer-term yields play a role in shaping financial conditions. Short-term rates are set directly through central bank policy, while long-term rates are influenced by market expectations and bond markets.

Changes in either can affect everything from corporate financing to consumer credit costs.

Demographic and Structural Considerations

Japan’s aging population and slow population growth have long been factors in its economic outlook. These demographic trends influence demand for credit, savings behavior and long-term growth prospects, all of which have bearings on interest rate policy.

This context helps explain why Japan’s interest rate history differed so widely from other advanced economies that faced rapid inflation and tightening cycles.

Frequently Asked Questions (FAQs)

What are Japanese interest rates right now?

Japanese interest rates are in positive territory after recent rate increases, representing a shift from previous decades of near-zero or negative levels.

Why were Japanese interest rates so low for so long?

Years of slow growth and deflationary pressure led policymakers to keep rates extremely low to try to stimulate lending and economic activity.

Have Japanese interest rates increased recently?

Yes. Policymakers have raised rates following the end of negative rates and further incremental increases driven by inflation dynamics.

Elevate Your Brand with MasterInDesign 🚀

Don’t let your business get left behind in today’s fast-paced digital world. At MasterInDesign, we specialize in helping brands stand out, engage audiences, and grow online.

Our services include:

Take the next step toward digital excellence. Contact us today and transform your brand into a powerful online presence!