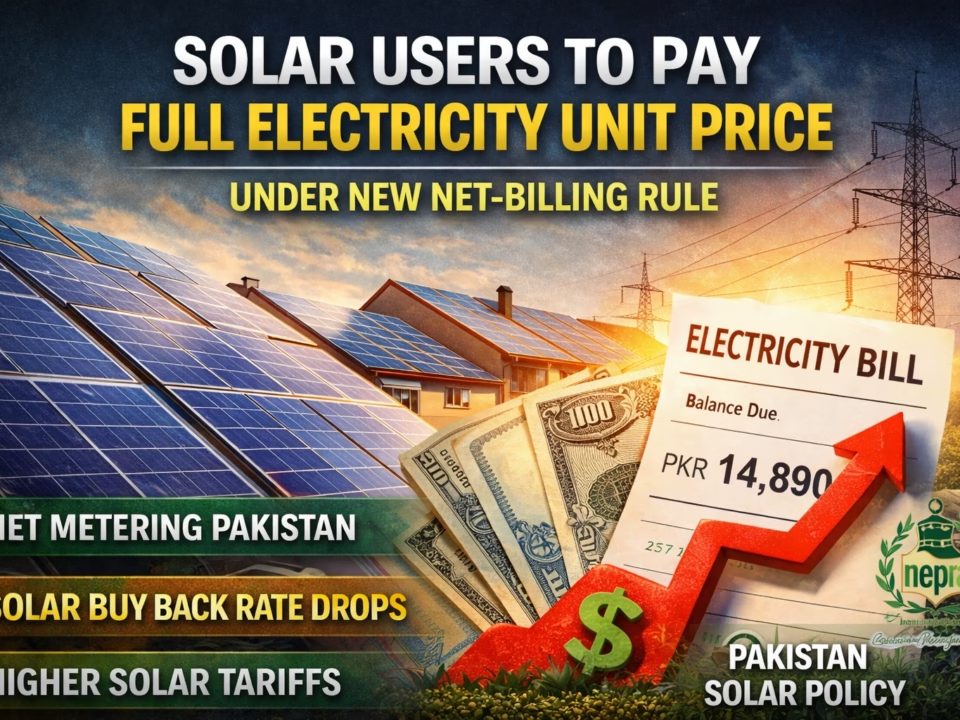

Solar Users to Pay Full Electricity Unit Price Under New Net-Billing Rule

February 10, 2026Rupee Climbs Against US Dollar for 97th Consecutive Day

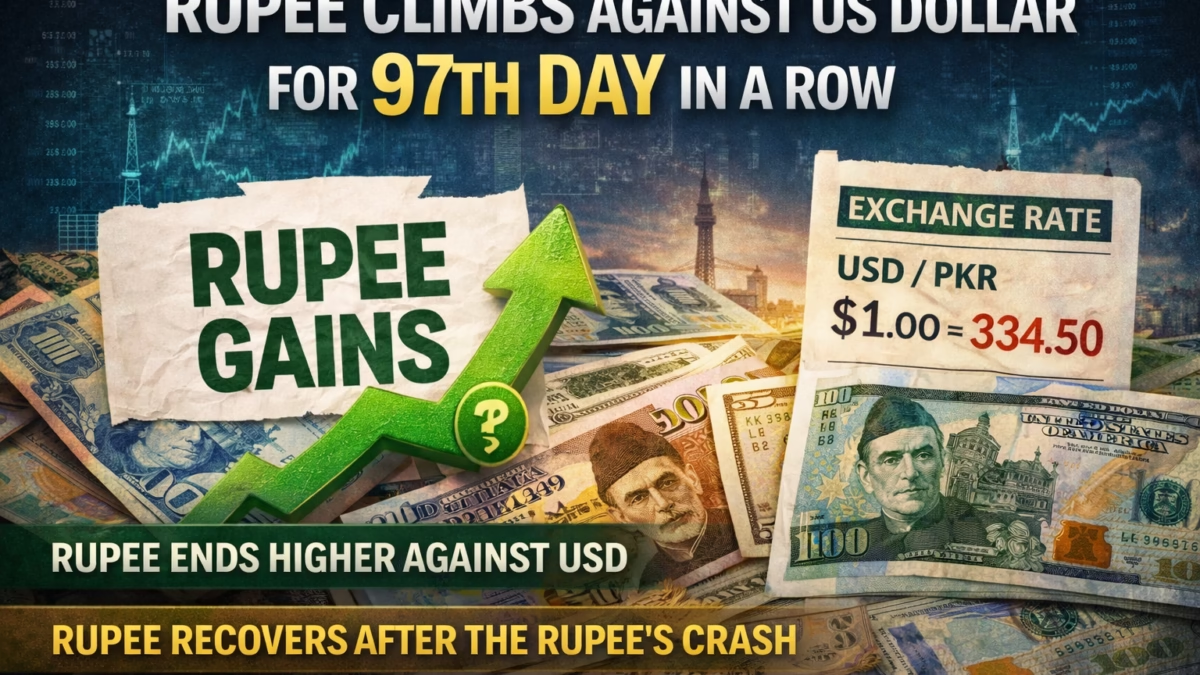

The Pakistani rupee has continued its remarkable recovery, marking its 97th consecutive day of gains against the US dollar. This trend has grabbed the attention of investors, businesses, and analysts alike as the rupee shows resilience after months of volatility. Experts highlight multiple factors contributing to the positive momentum, and the trend has significant implications for Pakistan’s import-dependent economy and foreign exchange markets.

In recent trading sessions, the US dollar climbs to over 334 against rupee in open market, reflecting minor resistance at higher levels. Despite this, the rupee continues to recover against the dollar, highlighting a steady improvement in market confidence.

Why the Rupee Is Strengthening

The recovery of the Pakistani rupee has been attributed to several key factors:

- Foreign Inflows: Foreign investments, including remittances and capital inflows, have provided consistent support to the rupee. These inflows enhance dollar liquidity and help stabilize exchange rates.

- Government Measures: Policy interventions by the State Bank of Pakistan, including interest rate management and forex reserve stabilization, have bolstered confidence in the local currency.

- Exports and Trade Balance: A pickup in export activity and a narrowing trade deficit have contributed to the rupee’s strengthening.

- Investor Sentiment: Positive market sentiment and speculation of future economic stability have driven demand for the rupee, reinforcing the upward trend.

Due to these factors, the rupee ends higher against dollar almost daily, showing an unprecedented streak of positive performance in recent months.

Impact of Rupee Recovery on the Economy

The consistent rise of the rupee has broad implications for Pakistan’s economy:

- Imports Become Cheaper: A stronger rupee reduces the cost of imported goods, machinery, and raw materials, providing relief to businesses and consumers.

- Inflation Control: Cheaper imports can contribute to easing inflationary pressures, particularly for commodities priced in dollars.

- Debt Servicing: Pakistan’s external debt obligations, often denominated in dollars, become relatively cheaper to service as the rupee appreciates.

- Investor Confidence: Sustained gains attract both domestic and foreign investors, stabilizing financial markets.

This recovery also contrasts sharply with periods of currency stress, popularly referred to as the rupees crash, demonstrating a significant reversal in market dynamics.

Daily Trading Highlights

In the open market, the rupee has been showing consistent gains against the US dollar. Analysts report:

- Interbank and Open Market Activity: While the US dollar climbs to over 334 against rupee in open market, the rupee still maintains a stronger position compared to past months.

- Market Expectations: Traders and businesses are increasingly confident in holding rupees, expecting further appreciation.

- Central Bank Intervention: The State Bank has strategically allowed the currency to strengthen without disrupting market stability, ensuring rupee gains against US dollar are sustainable.

These daily movements reinforce the narrative that the rupee is no longer in a free fall and has entered a phase of calculated recovery.

Why Analysts Are Cautious

Despite the positive trend, experts caution that multiple factors could impact the rupee’s sustained recovery:

- Global Dollar Strength: A stronger US dollar in global markets can temporarily pressure emerging market currencies, including the rupee.

- Oil and Commodity Prices: Pakistan’s heavy reliance on imported oil makes the rupee vulnerable to fluctuations in global crude prices.

- Political and Economic Stability: Domestic uncertainty can affect investor confidence and capital flows, influencing currency performance.

Nonetheless, the rupee’s 97-day winning streak reflects significant resilience and suggests that, for now, the currency has regained some stability.

What the Public Feels

Consumers and businesses have welcomed the rupee’s gains, as it directly affects daily transactions and purchasing power:

- Households: Cheaper imported goods and reduced pressure on inflation have been tangible benefits.

- Businesses: Companies reliant on imported raw materials enjoy lower costs, potentially passing savings to consumers.

- Investors: Confidence in the local currency supports long-term investment strategies.

The ongoing recovery is a morale booster after months of uncertainty and highlights effective currency management.

Looking Ahead

The trajectory of the rupee suggests cautious optimism. Market watchers predict:

- Continued Gradual Recovery: Provided foreign inflows remain consistent and trade balance improves, the rupee is expected to recover against dollar further.

- Stabilization: While volatility cannot be completely ruled out, the currency is likely to maintain a stable range due to policy support and investor confidence.

- Impact on Inflation: Continued rupee strength could help control inflation, easing the cost of living and boosting consumer confidence.

Overall, while challenges remain, the rupee ends higher against dollar for most trading sessions, signaling a positive shift in Pakistan’s financial landscape.

Conclusion

The Pakistani rupee’s 97-day consecutive gains against the US dollar mark a significant turnaround from previous periods of volatility and depreciation. While the US dollar climbs to over 334 against rupee in open market, the overall trend shows that the rupee is on a path of steady recovery. Sustained improvements in policy, foreign inflows, and market sentiment are contributing to the currency’s strength, with benefits felt across households, businesses, and investors.

Although analysts remain cautious about global and domestic risks, the current performance underscores a new phase of resilience for Pakistan’s currency, and the market is watching closely to see whether the streak of rupee gains against US dollar can continue

FAQs

Q1: Why is the rupee climbing against the US dollar?

The rupee is strengthening due to foreign inflows, positive investor sentiment, improved exports, and government measures to stabilize the currency.

Q2: What does “the rupees crash” refer to?

It refers to previous periods when the Pakistani rupee sharply depreciated against the US dollar, causing inflation and higher import costs.

Q3: How does rupee recovery affect imports?

A stronger rupee makes imports cheaper, reducing costs for businesses and consumers who rely on imported goods and raw materials.

Boost Your Brand with MasterInDesign 🚀

In today’s fast-paced digital world, staying visible is key. At MasterInDesign, we help brands shine, captivate their audience, and grow their online presence effectively.

Ready to level up your digital game? Reach out to us today and turn your brand into a standout force online