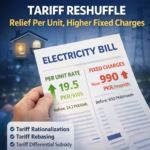

Tariff Reshuffle: Relief Per Unit, Higher Fixed Charges Explained

February 11, 2026

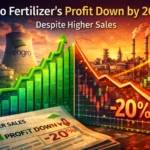

Engro Fertilizer Profit Down 20% in 2025 | Despite Higher Sales

February 12, 2026📈 China’s AI Market Sparks Optimism

China’s stock market showed mixed results this week as A-shares rose on optimism about artificial intelligence (AI), while Hong Kong shares slipped. Investors are increasingly focused on the rapid developments in China’s AI sector, with many viewing the latest innovations as a potential driver of economic growth.

The surge reflects Chinese AI market optimistic despite scrutiny from West, as regulators and global investors closely monitor developments in AI models and technology infrastructure. Companies leveraging AI for cloud computing, autonomous driving, and enterprise solutions saw notable gains, contributing to the overall rally in A-shares.

🌏 Asia Shares Mostly Firmer Amid Stimulus

Beyond China, broader Asian markets have generally been firmer. Analysts point to policy measures and stimulus announcements from Beijing as factors supporting market sentiment. As one observer noted, Asia shares mostly firmer as China announces more stimulus, showing that government interventions can offset short-term volatility.

Despite this, some investors remain cautious. The contrast between the optimism surrounding AI advancements and the scrutiny from international regulators has created a complex investment environment.

💹 Hong Kong Market Slip

While mainland China’s A-shares rose, Hong Kong markets experienced a modest decline. Analysts attribute this divergence to a mix of capital outflows and investor sentiment influenced by global uncertainty. Global funds back to selling Chinese stocks as optimism fades highlights that foreign investors remain cautious despite domestic enthusiasm for AI and economic stimulus.

The market reaction underscores how getting ahead in today’s China from optimism to pessimism can be rapid, as sentiment swings between enthusiasm for AI and caution about regulatory or geopolitical pressures.

🤖 China’s AI War of a Hundred Models

China’s AI sector has been described as a war of a hundred models, with numerous companies developing competing AI solutions for industries ranging from healthcare to finance. Analysts predict that this highly competitive landscape is heading for consolidation or a shakeout, as weaker players are eliminated and leading firms dominate market share.

This dynamic has reinforced the China optimism narrative for domestic investors, who anticipate that surviving AI firms will become major global players. However, international investors remain watchful, particularly given concerns over governance, ethics, and regulatory alignment.

🔄 From Optimism to Pessimism

The rapid shifts in market sentiment highlight the delicate balance of investor psychology in China. On one hand, AI innovation, government stimulus, and strong domestic consumption drive optimism. On the other hand, global funds back to selling Chinese stocks as optimism fades, reflecting international caution about risk, transparency, and geopolitical tensions.

Investors and analysts are constantly monitoring whether optimism will translate into sustainable growth or whether regulatory scrutiny and international pressures will dampen sentiment.

💡 Implications for Investors

For domestic and international investors, the current market environment presents both opportunities and risks:

- AI Investment Potential: Companies leading the AI revolution in China may see rapid revenue growth and strong stock performance, especially in sectors like semiconductors, cloud computing, and robotics.

- Volatility Awareness: Markets can swing quickly between optimism and pessimism, so investors should prepare for short-term volatility.

- Global Scrutiny Impact: Regulatory or geopolitical concerns from Western governments can influence capital flows and stock valuations.

By understanding these dynamics, investors can better navigate the landscape of China’s AI war of a hundred models and position themselves strategically.

FAQ

Q1: Why did China’s A-shares rise recently?

A1: A-shares rose due to optimism around AI innovation and new government stimulus measures supporting domestic companies.

Q2: Why did Hong Kong markets slip while A-shares climbed?

A2: Hong Kong declined due to global investor caution and partial capital outflows, highlighting mixed sentiment despite domestic optimism.

Q3: What does “Chinese AI market optimistic despite scrutiny from West” mean?

A3: It means China’s AI sector is advancing and gaining investor confidence, even as Western governments and regulators closely monitor AI development.

Elevate Your Brand with MasterInDesign

Don’t let your business get left behind in today’s fast-paced digital world. At MasterInDesign, we specialize in helping brands stand out, engage audiences, and grow online.

Take the next step toward digital excellence. Contact us today and transform your brand into a powerful online